Overview

As the Fraudulence in the financial sector is increasing rapidly, it becomes necessary to trace any suspicious transactional behavior of a customer. We are introducing the Bank Statement Analyzer to curb the illegal activity that ruins the financial sector. Now the analyzing process becomes swift and easy for the customer along with the security protocol in place. With the security in check the business can analyze their consumer’s bank statement on a click to identify the fraudulent risk of the account holder.

Goals

- Bank Statement Analysis enables businesses to check the financial behavior of their customers.

- Bank Statement Analysis can identify the International Transactions, Bill Payments, Bank Charges, Auto Debit etc.

Hassle free on-boarding of customers, and can be used by the financial institution to check their customers lending capacity. - Bank Statement Analysis enables businesses to check the financial behavior of their customers.

- Bank Statement Analysis can identify the International Transactions, Bill Payments, Bank Charges, Auto Debit etc.

Hassle free on-boarding of customers, and can be used by the financial institution to check their customers lending capacity.

Specifications

BSA is introduced to curb and verify the partners risk appetite and to mitigate the pain of manually reviewing the document and analyzing it.The user has to upload the bank statement and it will result in the analyzed report of the statement with multiple factors to check the credit risk of the customer it finds the daily EOD balance check, Bounce transactions, top 5 debits & credits with the predictor and fraud assessment.

Features:

- It can analyze the fraud types.

- It can analyze the Bank Statement up to 20mb.

- It can recognize the credit / debit profile along with the loan & Salary profile.

- It has the ability to identify the auto debited payments.

- Calculate and Generate the report spent percentage into different categories.

- BSA can fetch the Bounce cheque and Number of bounce transactions for both inwards and outwards.

- BSA can detect the debited emi transactions along with average emi transaction size.

- BSA fetches auto credit/debit self transfer.

- BSA recognizes and fetches the salary profile.

Details fetched in Bank Statement Analyzer

- Account Summary

- Overview

- Overall Transactions Details

- Daily EOD Balance

- Top 5 Credits/ Debits

- Bounce Transactions

- Profiles: Credit/Debit/ Salary

- Fraud Type and Predictors

- Bounce Transactions

Authentication API’s Outcome

| Validation using Uploaded Bank Statement |

|---|

| Bank_Statement_Analyzer_Report |

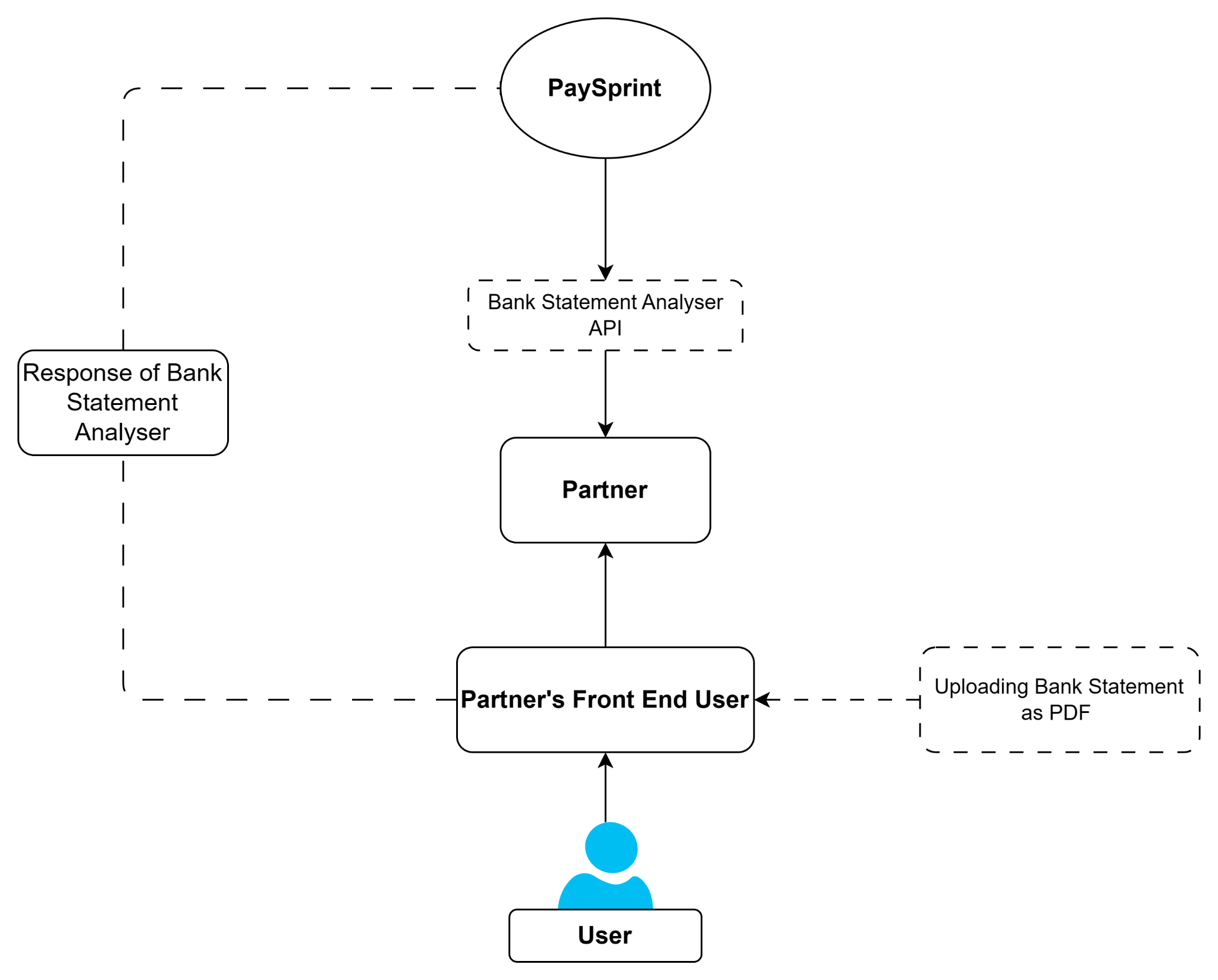

Process Flow