Overview

A Permanent Account Number is also known as PAN is a must-have document for any taxpayer. All those who earn or receive an income, are liable to pay taxes on it. Every individual needs to have a PAN card in order to become an eligible taxpayer. Also, to open a bank account, be it a savings or current account, a PAN card is needed. For tax-paying as well as loan purposes their PAN card is verified to make sure that the individual is legitimate and has not been involved in any fraudulent activities.

Goals

- Verify the financial status of a customer.

- Identify No of GST linked with PAN cards.

Specifications

PAN to GST Verification API helps you identify the number of GST linked to a PAN CARD with reliability and ease. This will help you determine the legitimacy of the customer while preventing any fraudulent activities. Even the Income Tax Department advises using online PAN verification API systems for certain institutions and entities to verify their customer credibility. All we require for this process are the selective credentials of the customer.

Authentication API’s Outcome

Linked GST numbers on a particular PAN

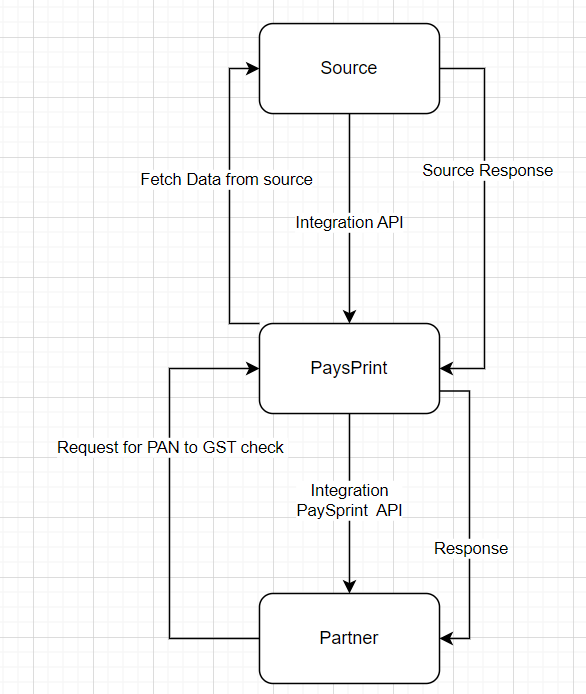

Process Flow