Overview

What exactly is a credit score? A credit score is a financial metric that shows the credit worthiness of a user/business and is used to decide the eligibility for a loan. When we applied for a loan, a credit card, or pay later service. At that time Financial institutions like banks use this information to measure the ability of a customer to repay the loan and the risk of default associated with it.

Goals

- To Know Credit history & score to understand purchase patterns & repayment behavior.

- Reduce the risk of default and increase the chances of simplified collections for your business.

- Fetch the entire credit report with just a simple API call via mobile number & name.

Specifications

Your Credit score is an important factor that lenders look at while evaluating a loan application. The Credit score reflects your credit-worthiness, based on your borrowing and repayment history. A credit score is a three-digit number, typically ranging from 300 to 900. Along with your background & details. A score above 700 is generally considered good.

PaySprint API platform has Credit Score Check APIs to help businesses like yours speed up customer onboarding time by 95% and provide a seamless experience to your customers, partners, and vendors!

Our Credit score API can provide you with a credit score which enables you to create multiple business use cases.

Difference Between Credit Report & Credit Score

The main difference between credit reports and credit scores is that a credit score is a numerical value that is used as a quick means for lenders & financial institutions to decide whether the loan applicant is eligible for credit.

On the other hand, a credit report is a comprehensive & detailed document containing the applicant's financial history.

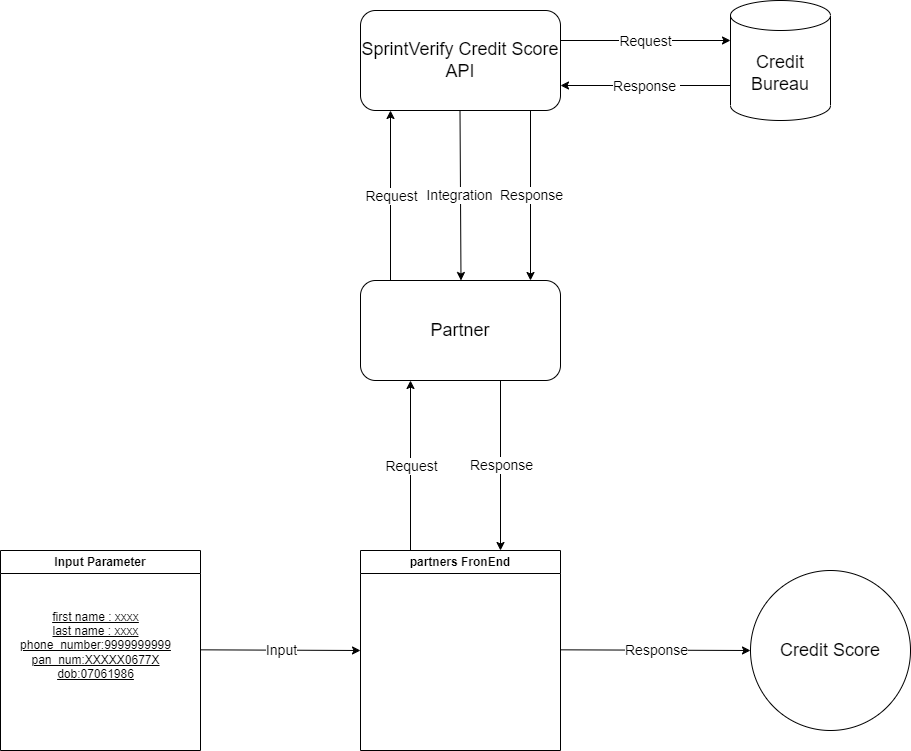

Process Flow