Overview

With the growing fraudulence in the financial sector, to trace any suspicious behavior it has become essential to keep proper records of customers.

CKYC norms were introduced to curb the illegal activity that ruins the financial sector.

With the introduction of the Central Know Your Customer (CKYC) registry, the documentation process has now become simpler and quicker for the customer, and importantly safer for all.

CKYC is the abbreviation for Central Know Your Customer. It is a centralized repository that stores or saves all the personal details of the customer. Earlier, there was a separate KYC process for every financial entity.

The Central Government launched CKYC. This helps to bring all the KYC processes into a single platform.

Goals

- CKYC once registered enables the financial company to verify the KYC documents of the investor easily.

This onboarding process becomes hassle-free for both the investor and the financial institute. - CKYC Identifier is valid pan India and can be used when opening an account with any financial institution

regulated by RBI, SEBI, IRDAI, and PFRDA. - Investors also have access to their CKYC verification. They can update their details in the CKYC registry

anytime with not much effort.

Specifications

KYC was introduced in February 2017. with the introduction of CKYC, the customer need not go through the same pain of documentation.

The data is stored under one roof. This data is further available for authorized financial organizations to have access to it.

And users do not have to revisit the process of KYC again when investing with any other financial institute.

CKYC helps both the customer and the financial institute skip the hassle of documentation.

The following are the features of CKYC:

● CKYC is a 14-digit number that is linked with the customer’s ID proof.

● The data is then safely stored in electronic format.

● The document submitted is then verified with the issuer

● All the concerned institutions are notified when there is a change in the KYC details.

Documents Fetch in CKYC:

● PAN Card

● Aadhaar Card

● Voter ID Card

● Driving Licence

● Passport, or

● NREGA Job Card

Document Type

| Document Type | ID Number |

|---|---|

| PAN | 10 digit PAN number of that person. Example: "AAAAA1111A". |

| Aadhaar | A combination of 4 details: 'last 4 digits of AADHAAR', 'Name as on AADHAAR', 'Date of birth as on AADHAAR in dd-mm-yyyy format' and Gender: Male 'M', Female 'F' or Other 'T'). Example: "4**1|SouravGhosh|20-03-1995|M" |

| Passport | A valid Passport number of the customer. |

| Voter ID | A valid Voter ID number of the customer. |

| Driving License | A valid Driving Licence number of the customer. |

| CKYC | A valid 14 digit CKYC number of the customer. |

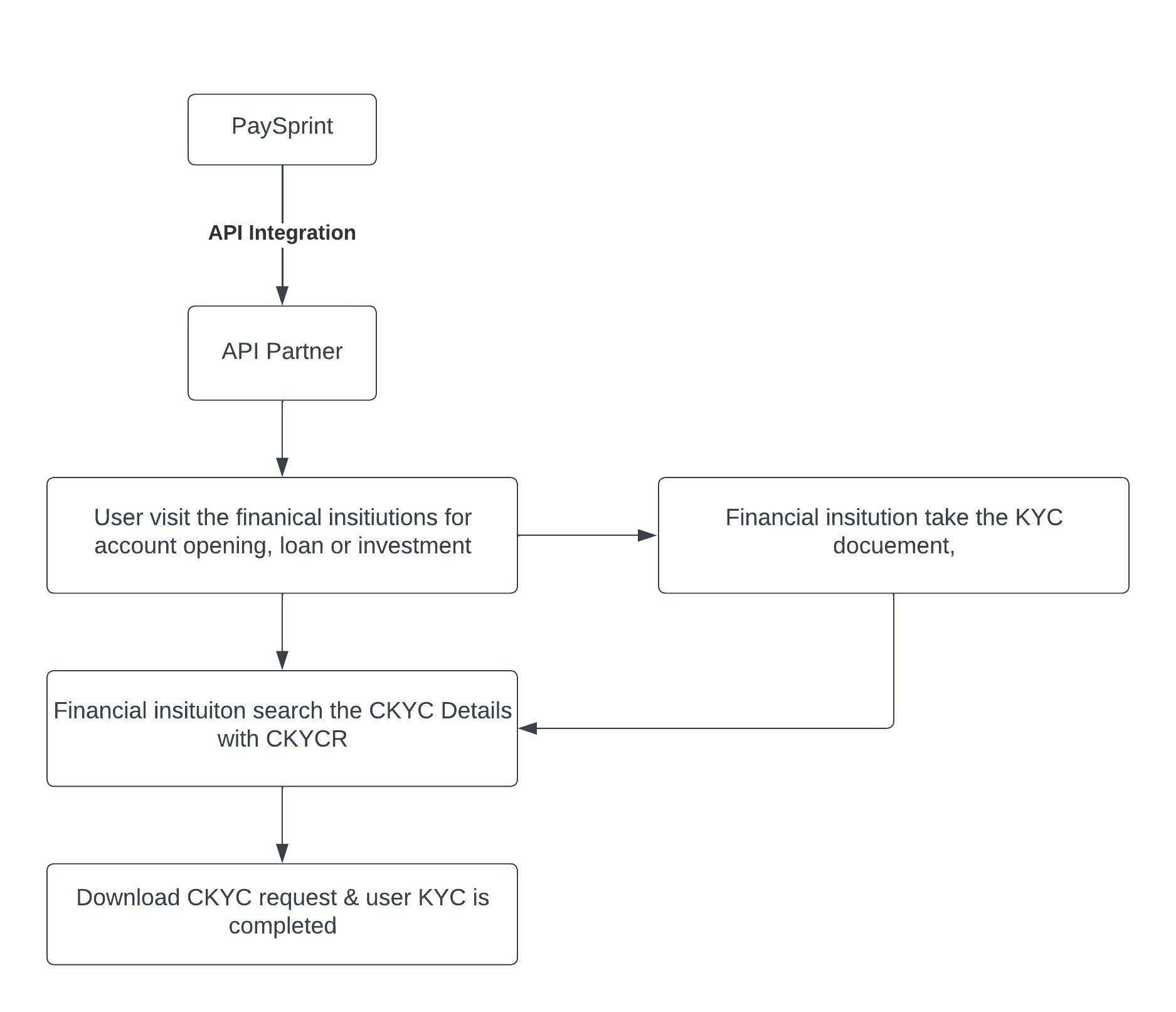

Product Flow

Auth Factor

| auth_factor_type | auth_factor |

|---|---|

| 1 | Date of birth in the format: "yyyy-mm-dd". Example: "1993-03-29". |

| 2 | A combination of the 6-digit pin code and the year of birth. Example: "5600171992" where 560017 is the pin code and 1992 is the year of birth. |

| 3 | A valid 10-digit mobile number of the person whose AADHAAR is linked with. Example: "9001122339". |